Invited Testimony of IDRA – Presented by David Hinojosa, J.D., National Director of Policy, before the Texas School Finance Commission, March 19, 2018

Chairman and Justice Brister and Members of the Commission:

Thank you for opportunity to present testimony of IDRA’s research and analysis of equity in the Texas school finance system. IDRA is an independent, non-profit organization that is dedicated to assuring equal educational opportunity for every child through strong public schools that prepare all students to access and succeed in college. Since its founding in 1973, IDRA has conducted extensive research and analysis on Texas school finance, which have been used to help inform policymakers and advocates.

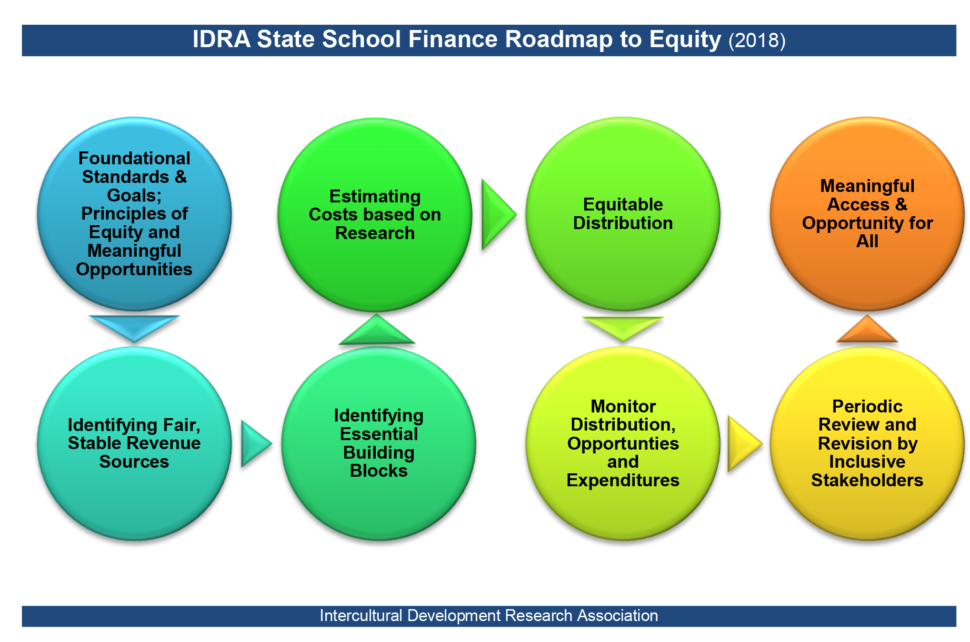

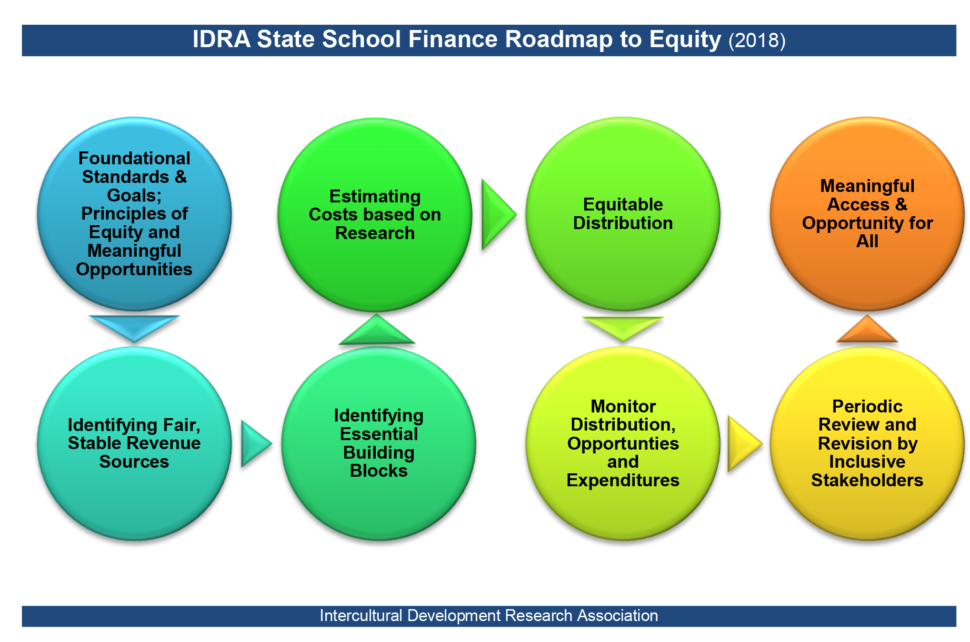

A Roadmap to Equity: Creating Meaningful Educational Opportunity for All

Strong, recent research shows that increased funding has contributed to both improved student performance and lifetime outcomes, especially for underserved students (Jackson 2016; Lafortune 2016). Yes, money matters, and how that money is spent and on which children, also matters. Below is a research- and equity-based model that states can follow to ensure that all children access the meaningful educational opportunities they need to succeed in school and in life.

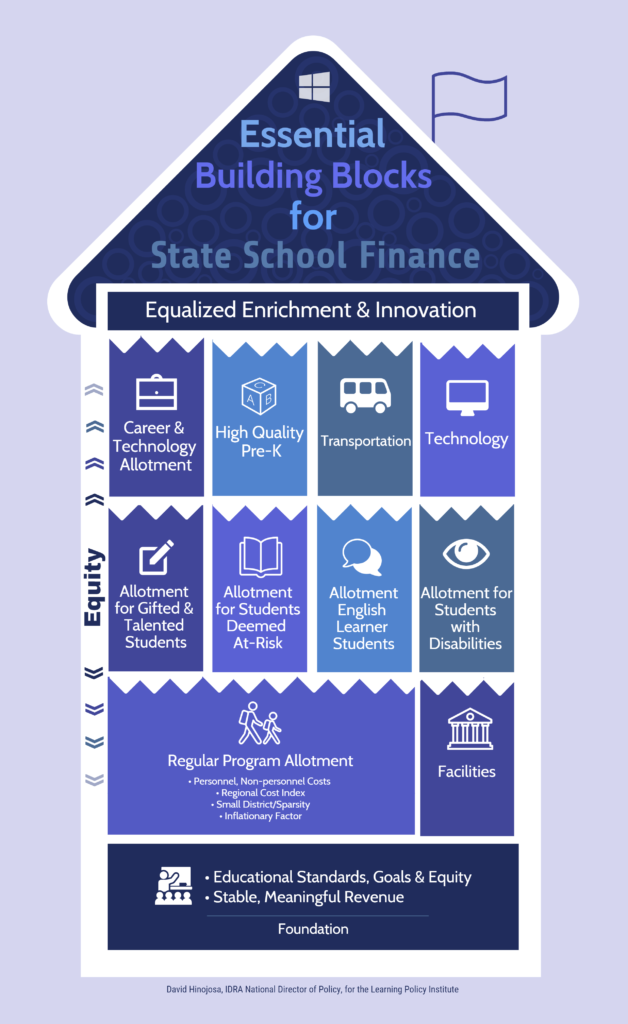

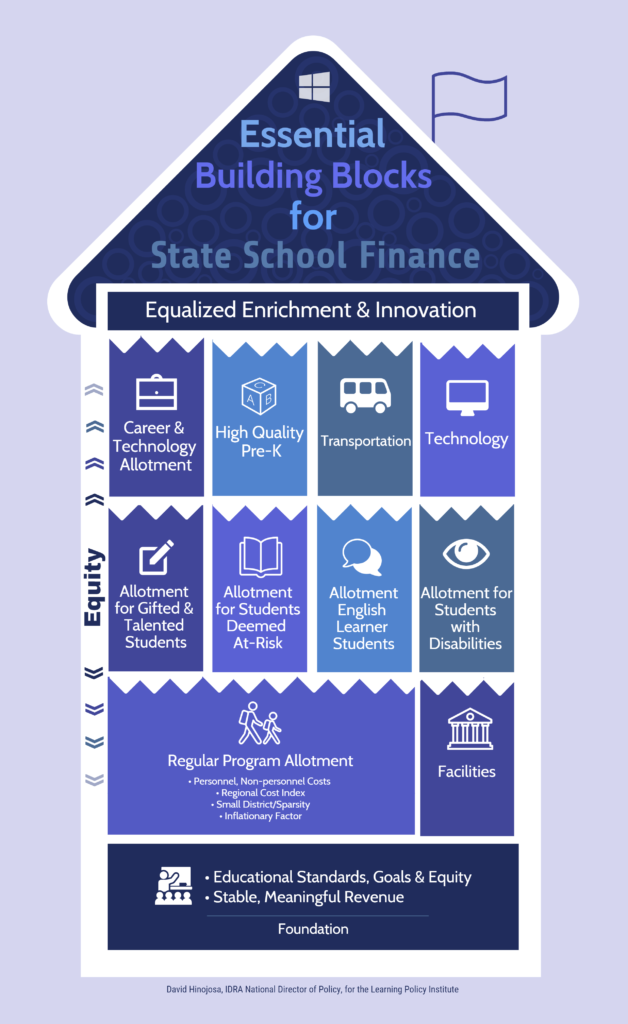

Essential Building Blocks of Equitable School Finance Systems

IDRA is working with the Learning Policy Institute on a brief that will help inform policymakers and advocates in creating a strong, equitable school finance system that provides an excellent education for all students. The brief focuses on the first three stages identified above: (1) foundational standards, goals and principles; (2) identifying fair and stable revenue sources; and (3) identifying essential building blocks, which are grounded in legitimate and necessary costs reflecting meaningful student learning and opportunity, and promising practices in the states. Part of the focus of our testimony today centers on this third step.

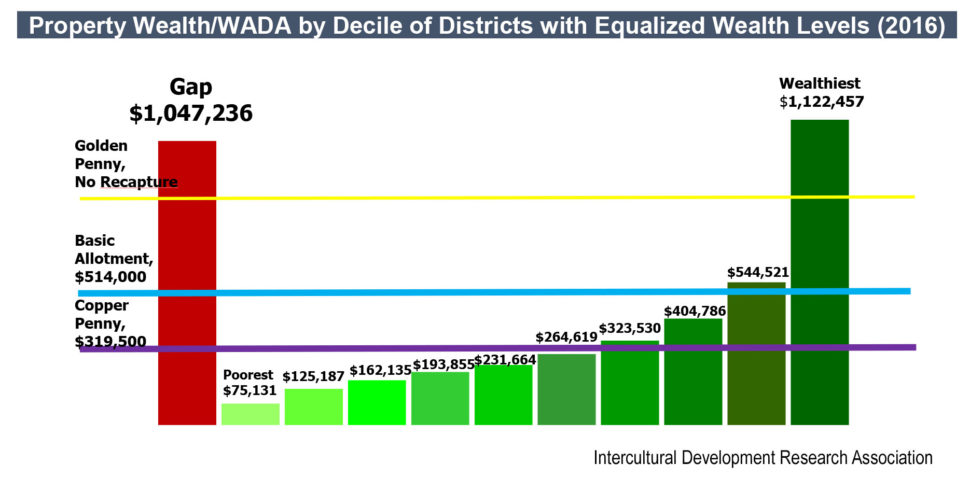

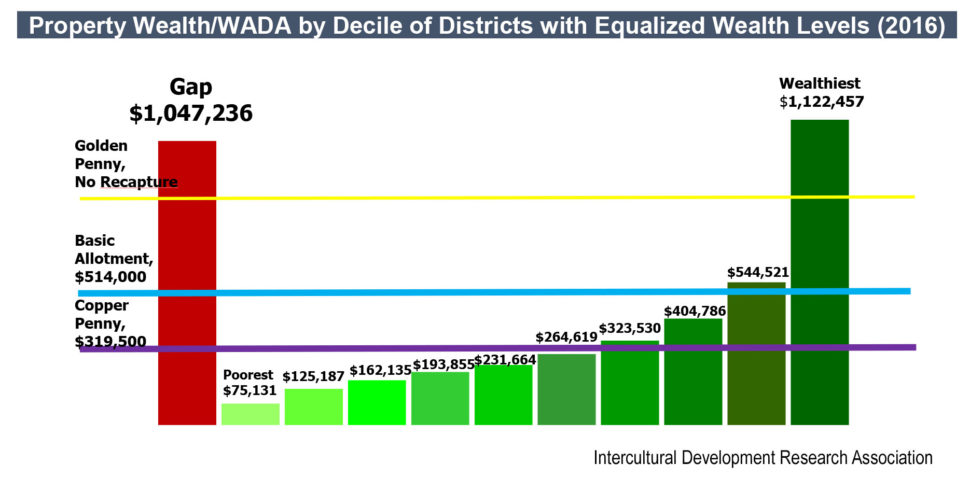

Texas’ Continuing Reliance on Disparate Property Values

Texas continues to rely heavily on local property taxes that remain, and will continue to remain, incredibly disparate across the state. As noted in the chart below, the wealthiest decile (10 percent) of districts have property values greater than $1 million per weighted student compared to the poorest decile. On average, the wealthiest districts educate fewer economically disadvantaged, students of color and English learners than the poorest districts. The state has used equalized wealth levels for maintenance and operations funding (not facilities funding) for various tiers of funding; however, as noted further below, there are several statutes that contribute to the lingering inequities of the Texas school finance system.)

Texas Legislature’s Inequity Drivers

Over the past three decades, the legislature has struggled mightily to ensure that all children in Texas have equitable and meaningful opportunities in the classroom. Below are some inefficient features of the current school finance system that continue to allow mostly property-wealthy school districts sizable funding advantages over mid- and low-wealth school districts:

- 1993 Hold-harmless provisions (for approximately 37 property-wealthy districts)

- Available School Fund (for Chapter 41 districts only)

- Unrecaptured golden pennies (districts with Property Revenue/WADA exceeding Austin ISD)

- Hold-harmless “Hardship” Grants (formerly ASATR)

- Inadequate weights for English learner and economically disadvantaged students

- High school allotment (benefits districts with lower dropout rates)

- Recapture credits

- Reliance on prior year’s values

- Facilities funding (no recapture)

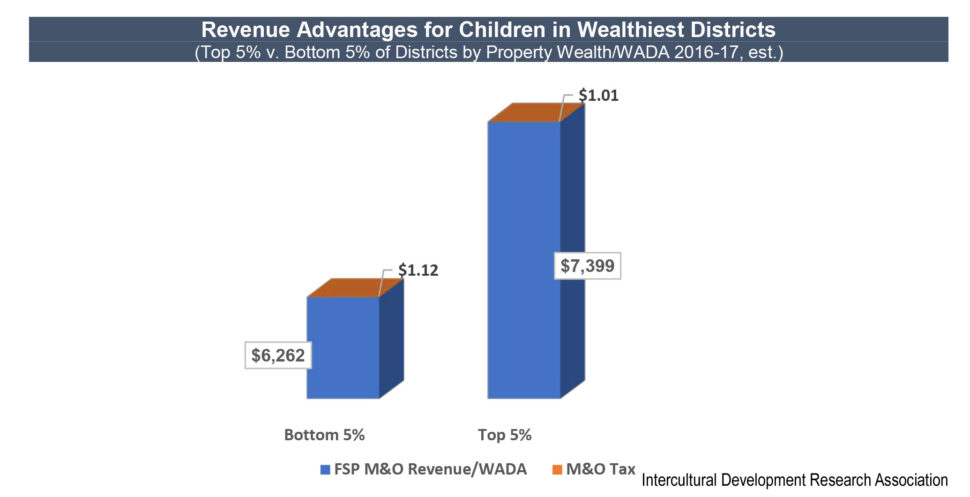

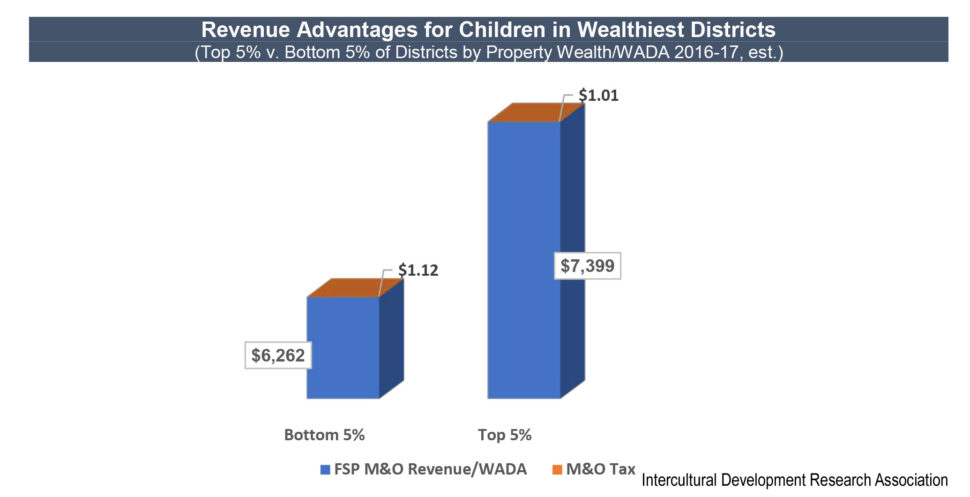

The Results: Inequitable Educational Opportunities

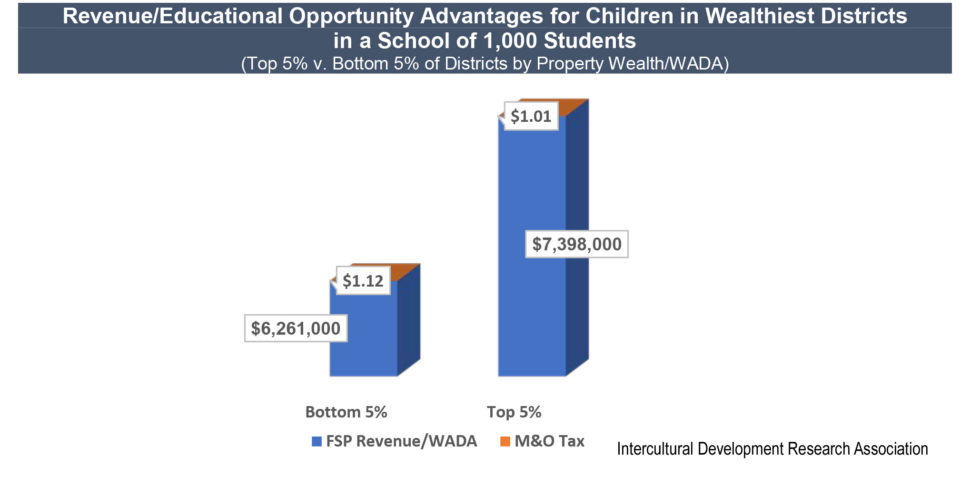

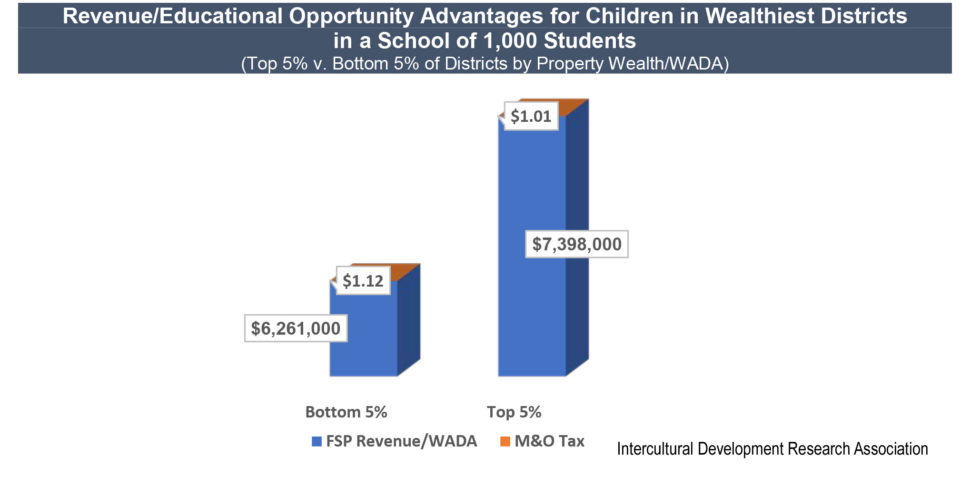

Despite formulas that are intended to equalize opportunities for school children across Texas, the wealthiest districts can tax much lower and still access far greater revenues. As shown below, despite taxing 11¢ less than their counterparts, the top 5 percent of property-wealthy school districts in the state access over $1,100 more per WADA than the bottom 5 percent.

When that over-$1,100 advantage is applied to a school or district of one-thousand students, the wealthiest top 5 percent resource advantage grows to over $1.1 million. This could translate to expanded pre-K, more computers or better technology, greater professional development and mentoring opportunities for teachers and school leaders, increased instructional support, more teachers and reduced class sizes, among other educational opportunities-to-learn.

IDRA thanks the Commission for the opportunity to testify and stands ready as a resource. For additional resources, visit IDRA’s Fair Funding for the Common Good website. If you have any questions, please contact IDRA’s National Director of Policy, David Hinojosa, at david.hinojosa@idra.org or (210) 444-1710, ext. 1739.

Sources

Jackson, C.K., Johnson, R., Persico, C., The Effects of School Spending on Educational and Academic Outcomes: Evidence from School Finance Reforms, The Quarterly Journal of Economics 157-218 (Oxford University Press 2016).

Lafortune, J., Rothstein, J., and Whitmore Schanzenbach, D. School Finance Reform and the Distribution of Student Achievement, NBER Working Paper No. 22011 (National Bureau of Economic Research 2016).

The Intercultural Development Research Association is an independent, non-profit organization led by María Robledo Montecel, Ph.D. Our mission is to achieve equal educational opportunity for every child through strong public schools that prepare all students to access and succeed in college. IDRA strengthens and transforms public education by providing dynamic training; useful research, evaluation, and frameworks for action; timely policy analyses; and innovative materials and programs.