Invited Testimony of IDRA on SB 2145 before the Texas Senate Education Committee – Presented by David Hinojosa, J.D., IDRA National Director of Policy, April 18, 2017

Chairman Taylor and Members of the Committee:

Thank you for allowing the Intercultural Development Research Association (IDRA) the opportunity to present written testimony of its research and analysis on school finance.

IDRA is an independent, non-profit organization that is dedicated to assuring equal educational opportunity for every child through strong public schools that prepare all students to access and succeed in college. Since its founding in 1973, IDRA has conducted extensive research and analysis on Texas school finance, which have been used to help inform policymakers for the past five decades.

SB 2145 makes key advances on the equity equation of a sound, transparent and meaningful school finance system as envisioned by IDRA. Of the four school finance stands IDRA identified in its Priority Policy Issues in 2017, SB 2145 fulfills three of those important stands:

√ All state and local aid made available for public schools should be funded through equalized formulas.

√ All hold-harmless revenue, including Target Revenue, must be terminated and those funds should be redistributed through the formulae to help all school districts.

√ Efforts to reduce recapture must be done in an equitable manner, and the state must provide additional aid for all districts to make up the difference.

X State aid for underserved students, such as low-income and English learner students, must reflect actual costs.

Advances in Equity and Transparency

SB 2145 eliminates or modifies significantly many of the inefficient, inequitable and outdated components of the Texas school finance system. These include many of the components targeted under two comprehensive bills filed this session, HB 3474 and SB 704:

- Eliminates 1993 hold-harmless measures that favor select super-wealthy school districts,

- Eliminates early agreement tax credits for Chapter 41 districts paying recapture,

- Allows for termination of Additional State Aid for Tax Relief, and

- Modifies Available School Fund distribution to create greater equity.

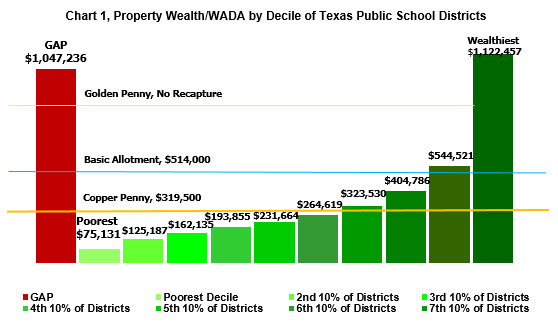

Many of these revisions will help close the equity gap of over $1,000 per student between the wealthiest and poorest school districts that is inherent in Texas’s continuing over-reliance on disparate property tax values across the state, as noted in the chart below.

IDRA’s Penny Power tool shows how weak some taxpayer pennies are compared to other districts across Texas as a result of the dysfunction of the Texas system.

Falling Well Short of Sufficient Opportunities for Underserved Students

As noted above, SB 2145 makes strong, necessary improvement in bringing greater equity between property-poor and property-rich school districts. SB 2145 also makes some adequacy-based, efficient changes by purportedly doing the following:

- Rolling in the high school allotment into formula funding

- Fully funding the Cost of Education Index

However, a major shortcoming in SB 2145 is the lack of attention to adequate funding, especially for low-income and English learner (EL) students. Strong, recent research shows that increased funding by the states has contributed to both improved student performance and lifetime outcomes, especially for underserved students (Jackson, 2016; Lafortune, 2016).

The weights for compensatory education and bilingual education remain unchanged since 1984, but the standards and expectations for students and schools continue to evolve. IDRA’s analysis of STAAR student group performance rates, college readiness outputs, graduation rates and dropout rates reflect significant gaps between economically disadvantaged and non- economically disadvantaged students and between EL and non-EL students, in spite of some success individual economically disadvantaged and EL students are experiencing in classroom across Texas.

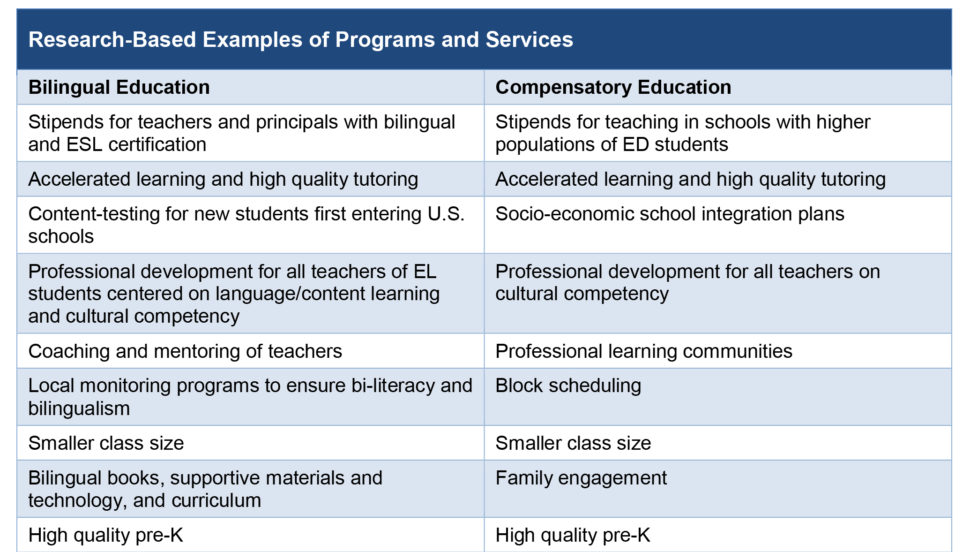

With such great and immediate need, there appears no reason the weights should not increase significantly for the next biennium while a cost study is being conducted to determine the more precise weights. This additional funding could help school districts provide a high quality education to all learners so long as the funding is carefully monitored. Some research-based examples of programs and services follow.

In addition, the indirect costs allowed for the bilingual and compensatory education allotments is currently set at approximately 47 percent. To make the system more efficient, and to ensure that more revenue generated by those students actually reaches those students, IDRA recommends that the allowable indirect costs be decreased.

Accordingly, IDRA recommends the following:

- Increase the allotments for both bilingual education and compensatory education to 0.25.

- Decrease the allowable indirect costs for the bilingual and compensatory education allotments to 25 percent.

The Need for an Evidence-Based Cost Study

Cost studies enable legislators to bridge educational funding policy with effective research and practice. Yet, Texas has historically funded its public schools based on available appropriations and politicking as opposed to actual student need. While the legislature should not delay an increase to the bilingual and compensatory weights, the legislature should consider ordering an independently conducted, evidence-based cost study of the public school finance system, with recommendations toward fully funding those costs.

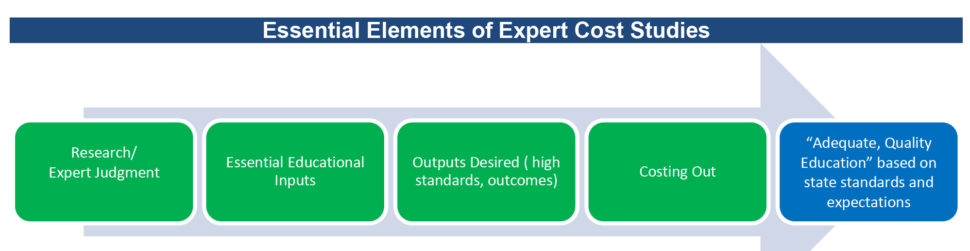

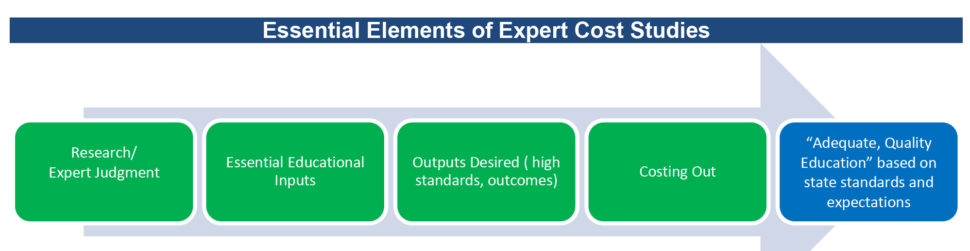

IDRA conducted one of the first cost studies on bilingual education in 1976 and has performed other cost studies, including in Arizona, Utah and Colorado. (Robledo, 2008). Expertly-designed and well-supported cost studies that follow the essential elements below can help provide the legislature with critical information that can enable it to support a high quality education for the state’s growing EL and ED students.

IDRA thanks this committee for the opportunity to testify and stands ready as a resource. If you have any questions, please contact IDRA National Director of Policy, David Hinojosa, J.D., at david.hinojosa@idra.org or 210-444-1710, ext. 1739.

Resources

Jackson, C.K., & R. Johnson, C. Persico. (2016). “The Effects of School Spending on Educational and Academic Outcomes: Evidence from School Finance Reforms,” The Quarterly Journal of Economics, 157-218 (Oxford University Press).

Lafortune, J., & J. Rothstein, D. Whitmore Schanzenbach. (2016). School Finance Reform and the Distribution of Student Achievement, NBER Working Paper No. 22011 (National Bureau of Economic Research).

Robledo Montecel, M., & A. Cortez. (2008). “Costs of Bilingual Education,” Encyclopedia on Bilingual Education, Vol. 1, 180-183.

The Intercultural Development Research Association is an independent, non-profit organization, led by María Robledo Montecel, Ph.D., dedicated to achieving equal educational opportunity for every child through strong public schools that prepare all students to access and succeed in college. IDRA strengthens and transforms public education by providing dynamic training; useful research, evaluation, and frameworks for action; timely policy analyses; and innovative materials and programs.