• IDRA Newsletter • January 2013 •

Editor’s Note: The following highlights are derived from research conducted by IDRA and reported in a series of studies entitled, “Extent of Equity in the Texas School Finance System and Its Impact on Selected Student Related Issues.” The IDRA research team included Dr. María “Cuca” Robledo Montecel, IDRA President; Dr. Albert Cortez, IDRA Director of Policy; Roy L. Johnson, IDRA Director of Support Services; Héctor Bojorquez, IDRA Education Associate; Charles A. Cavazos, IDRA Education Assistant; and Christie L. Goodman, APR, IDRA Communications Manager. The testimony was prepared and presented by Dr. Albert Cortez.

On December 3, 2012, Dr. Albert Cortez, IDRA’s Director of Policy, presented testimony in the Texas Taxpayer and Student Fairness Coalition vs. Michael Williams, et al., school funding trial in Austin. The testimony was based on a series of expert reports IDRA prepared for one of the plaintiffs, the Mexican American Legal Defense and Educational Fund, between August and November 2012.

On December 3, 2012, Dr. Albert Cortez, IDRA’s Director of Policy, presented testimony in the Texas Taxpayer and Student Fairness Coalition vs. Michael Williams, et al., school funding trial in Austin. The testimony was based on a series of expert reports IDRA prepared for one of the plaintiffs, the Mexican American Legal Defense and Educational Fund, between August and November 2012.

Using Texas public school district data from the Texas Attorney General’s Office, IDRA conducted analyses for the 2009-10, 2010-11 and 2011-12 school years. We particularly focused on school funding equity, program funding for educating English language learners and low-income students, and the impact of special population program cuts adopted by the 2011 Texas legislature. This article provides highlights of our analysis and testimony presented at the trial. More detailed information is available online at www.idra.org.

Methods

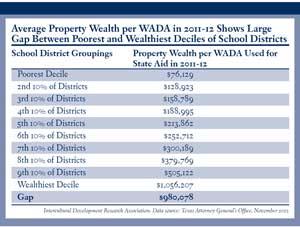

To assess the extent of funding equity across school districts of varying property wealth per weighted student (WADA), IDRA rank-ordered school districts by their property wealth per WADA and then divided them into 10 groups with each containing 103 districts, except the 10th decile, which had 97. IDRA tabulated the total wealth for each district group and divided this by the group’s total number of weighted students to arrive at a weighted property wealth per WADA for each group of districts.

In a similar manner, IDRA calculated the average maintenance and operations (M&O) revenue per WADA for each group by totaling each district’s 2011-12 revenue at its 2011 adopted tax rates and dividing that by the group’s cumulative WADA. Using similar methodology, IDRA calculated the group average M&O revenue based on the projected revenues that would be available if all districts were taxing at the maximum $1.17 rate allowed under existing state law.

School Funding Disparities in Texas School Districts in 2011-12

IDRA found that there was a property wealth difference of $980,078 per WADA between the lowest and wealthiest property wealth deciles of school districts (see table at right). This notable difference clearly impacted the amount of M&O revenue per WADA found in all groups of school districts, but it was most striking in the $1,324 gap found between the highest and lowest property wealth groups. In 2012, at districts’ adopted tax rates for that year, the poorest group of districts generated only $5,664, compared to $6,988 in the wealthiest district group (see graphic).

Multiplying that $1,324 in a class of just 20 students produces a disparity of $26,480

per classroom. In a school with 30 classrooms, the disparity grows to $794,400. This disparity occurred even as the lowest wealth district grouping exerted average M&O tax efforts that were 10 percent higher than the $1.00 adopted tax rate average found among the state’s wealthiest school districts.

If all school districts were to tax at the maximum allowed rate of $1.17, IDRA found that the disparity would be even greater. The poorest districts would generate an average of $5,866 per WADA, while the wealthiest decile would generate an average of $7,578 per WADA – for a disparity of $1,712 per WADA. This difference is notably greater than the disparities found in the Texas funding system in 2006 when the Texas Supreme Court issued its last ruling on this issue.

Impact of Increasing ELL and Low-Income Student Funding Weights

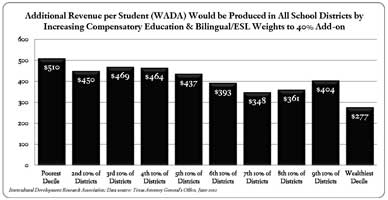

IDRA reviewed funding practices and studies related to educating English language learners (ELLs) and low-income (or “compensatory education”) students in states around the country and some that focused specifically on Texas. Based on this comprehensive review, it was recommended that the state increase funding for educating ELL students from the current 10 percent weight to a 40 percent weight and increase compensatory education funding from the current 20 percent add-on weight to 40 percent. IDRA’s analysis projected the resulting revenue for each school district. These estimates were based on 2011-12 district funding in each program with amounts adjusted upward to reflect the impact of the 40 percent add-on funding level.

The most important observation is that all groups of school districts enroll some number of ELL and low-income students, and all groups would benefit by increasing funding weights. The mid-groups (second through ninth deciles) show between $450 and $404 per WADA in increased revenue (see graph). The lowest wealth grouping of districts – having the highest concentrations of ELL and low-income students – would receive the greatest benefit per WADA ($501) compared to the wealthiest group of districts ($277).

Special Program Cuts and District Property Wealth Disparities

A final area examined in IDRA’s analyses involved assessment of special program cuts (specifically programs funded outside the Foundation school program and usually included as riders in the Texas appropriations bill) that were the subject of $1.2 billion in cuts in the 2011 Texas legislative session. Among the special program cuts were the following.

- Student Success Initiative, which supported programs targeting students at risk of academic failure;

- Educator Excellence Award Program;

- Texas High School Completion and Success program, which focused on dropout prevention;

- Pre-kindergarten Early Start Programs; and

- Texas High School Project, which concentrated funding for college readiness and STEM (science, technology, engineering and math) initiatives.

Using data acquired by the Mexican American Legislative Caucus from the Texas Education Agency and merged with school finance data provided by the Attorney General to MALDEF, IDRA calculated revenue losses for individual school districts and aggregated the data in the same property wealth deciles used in earlier sections of our report.

The results exposed the fact that the state’s poorest group of districts experienced the greatest overall cuts per WADA ($253), while the wealthiest group of districts experienced the smallest cuts ($19 per WADA). The special program cuts across all school districts averaged $161. Lacking state support for these programs, it is up to individual districts to make up the cuts with local property wealth variances, meaning that the lower the property wealth of the district, the greater the tax effort it would need to raise such funding entirely from local sources.

Conclusions

Based on our analyses, IDRA concluded that the Texas school finance system – with its continued support of unequalized funding and the target revenue mechanism that undermines the equity features of state’s funding formulae – is inequitable, provides inadequate levels of funding for educating ELL and low-income students, has disparate impacts on low property wealth and major urban school districts, and suffered special program cuts that negatively impacted students in low wealth school districts.

All of these results suggest that Texas still has a long way to go to achieve the objective of providing equal educational opportunity for all of its students. In Texas, the quality of schooling still is markedly affected by the neighborhood in which you happen to reside.

Resources

Cortez, A. The Status of School Finance Equity in Texas – A 2009 Update (San Antonio, Texas: Intercultural Development Research Association, 2009).

Cortez, A. The Cost of Inequity in Education – A Review of Policy-Related Research (Issue brief). San Antonio, Texas: Intercultural Development Research Association, 2010).

IDRA. Report of the Intercultural Development Research Association Related to the Extent of Equity in the Texas School Finance System and Its Impact on Selected Student Related Issues (San Antonio, Texas: Intercultural Development Research Association, August 2012).

IDRA. Supplemental Report of the Intercultural Development Research Association Related to the Extent of Equity in the Texas School Finance System and Its Impact on Selected Student Related Issues (San Antonio, Texas: Intercultural Development Research Association, October 22, 2012, and November 23, 2012).

IDRA. “IDRA Director of Policy, Dr. Albert Cortez, Testifies in School Finance Case,” statement (San Antonio, Texas: Intercultural Development Research Association, December 5, 2012).

Robledo Montecel, M., & Cortez, A. (2008). “Costs of Bilingual Education,” in Encyclopedia on Bilingual Education (Vol. 1, pp. 180-183). Sage Publications.

Albert Cortez, Ph.D., is director of policy at IDRA. Comments and questions may be directed to him via email at feedback@idra.org.

[©2013, IDRA. This article originally appeared in the January 2013 IDRA Newsletter by the Intercultural Development Research Association. Permission to reproduce this article is granted provided the article is reprinted in its entirety and proper credit is given to IDRA and the author.]