• by Morgan Craven, J.D. • IDRA Newsletter • June-July 2019 •

Texas’ 86th legislative session saw some of the most significant changes to school funding in decades. This issue of IDRA Newsletter summarizes highlights regarding education and how they relate to IDRA’s 2019 policy priorities.

Texas’ 86th legislative session saw some of the most significant changes to school funding in decades. This issue of IDRA Newsletter summarizes highlights regarding education and how they relate to IDRA’s 2019 policy priorities.

Prior to the start of the legislative session, the Texas Commission on Public School Finance met to provide recommendations for how the state could achieve an equitable school finance system. IDRA provided expert testimony at several hearings held by the commission, which was comprised of members selected by the Governor, Lieutenant Governor, chair of the State Board of Education, and Speaker of the House.

The commission issued its final report in late 2018 (CPSF, 2018). Many of its recommendations served as a basis for the major House and Senate school finance bills considered during the legislative session that opened in January. Following weeks of hearings and negotiations, the Texas Legislature approved House Bill 3, which impacts property taxes and funding for schools.

Major Funding Formulae Changes in HB 3

Basic Allotment – The basic allotment is the amount of funding a school district receives based on the number of students it serves. HB 3 increases the basic per-student funding from $5,140 to $6,160. Though it may seem all school districts will have an additional $1,020 per student, the legislation practically cancels out that increase for some districts by eliminating a number of “adjustments” that previously raised their basic allotment. For example, the Cost of Education Index (CEI) adjustment formerly increased the basic allotment by up to 20% in some school districts. In HB 3, monies “saved” from the elimination of components like the CEI were simply redirected into the basic allotment.

Current Year Values – HB 3 ensures alignment between how school districts and the state calculate budgets and spending by requiring the use of current-year property values, rather than some school districts’ prior-year values, to determine how much funding the state should provide to districts.

Special Student Population Allotment Rules – HB 3 changes the reporting requirements for how schools spend compensatory education and bilingual education funds. The bill requires schools to spend at least 55% of the funds on direct costs for students in the classroom. It expands the permissible uses of compensatory education funds to include a broader category of educationally disadvantaged students and requires that each school district’s independent auditor review how those funds are spent.

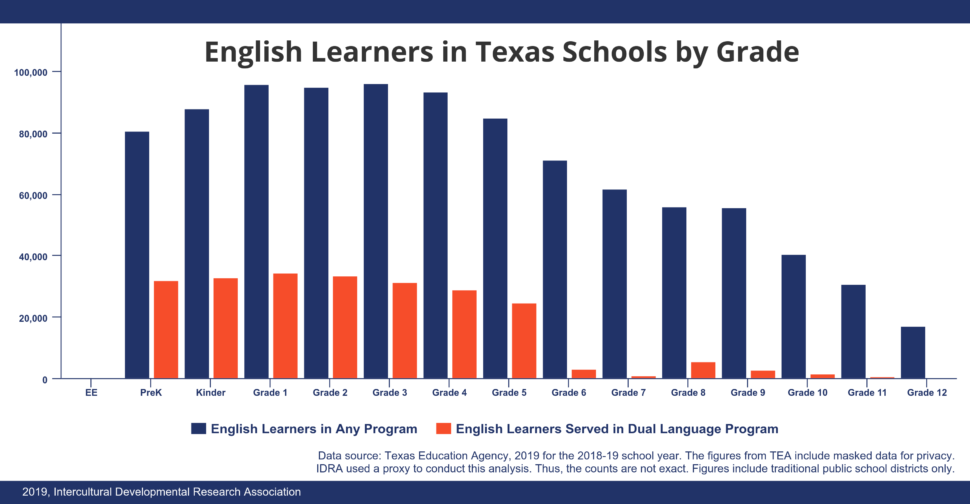

Dual Language Weight – HB 3 creates a new funding increase, or weight, for dual language programs. Schools will receive an additional 5% funding per student for each English learner and non-English learner in a dual language program. But because only a few school districts operate dual language programs, schools serving the roughly 80% of English learners in the state’s other bilingual and English as a second language programs will receive no additional funding from this new weight (IDRA, 2019).

Proficiency and Readiness Plans – HB 3 requires school district boards of trustees to adopt and post online plans for early childhood literacy and math proficiency and plans for college, career and military readiness. The plans must identify quantifiable goals for student performance for the following five years. The early childhood literacy and math proficiency plans also must provide for professional development for educators in schools that need additional support and may set separate goals for students in bilingual education or special language programs.

Full-day Pre-Kindergarten – Under HB 3, most school districts must adopt full-day pre-K programs for all qualifying 4-year-old students. While the state did not allocate funding specifically and exclusively for the pre-K programs, school districts may use new “early education allotment” funds for pre-K. The legislature created this allotment to improve third grade reading and math outcomes through a new funding weight of 10% for economically disadvantaged students and another 10% for English learner students in kindergarten to third grade.

Tiered Compensatory Education Funding – HB 3 creates a new system for calculating additional funds for educationally disadvantaged students and students deemed at risk of dropping out of school. The new five-tiered system allocates more money for educating low-income students who live in areas of concentrated poverty, based on American Community Survey and federal census data, with weighting levels increased as the concentration of poverty increases. While increased funding is critically important funding, it is unclear that the new tiered system will accurately capture varying levels of poverty across the state and allocate funds appropriately.

Teacher Compensation – Despite much debate this session, the state provided no specific new formulae to fund teacher salary increases. Instead, HB 3 requires schools to spend 30% of their total new per-student funding on compensation increases, with 75% of that amount dedicated specifically to teachers, librarians, nurses and counselors. The state leaves some discretion to districts to determine the distribution of compensation, with an emphasis placed on raises for teachers with more than five years of experience. The state does not specifically call for any raises for personnel with fewer than five years of experience.

Enrichment Funding – Enrichment refers to additional money collected by school districts beyond the funding needed to provide basic education services to students (as determined by statutory funding formulae). HB 3 changes the way school districts may increase their tax rates to collect enrichment funding.

Prior to HB 3’s adoption, districts could tax up to an additional 17¢ above their base tax rate, which was $1.00 for every $100 of taxable property value in most districts. The state guarantees that each cent will yield a specific amount of money for the districts and makes up the difference in funds for poorer districts that are unable to collect enough in local taxes to meet the guaranteed yield.

The first six of the 17 pennies are called golden pennies because they have a high guaranteed yield. HB 3 sets the guaranteed yield at the greater of the amount of tax revenue per student collected by school districts in the 96th percentile of property wealth or the basic allotment multiplied by 0.016. HB 3 also increases the number of golden pennies from six to eight, which means that the wealthiest school districts will be able to collect and keep more money for themselves.

Since wealthier school districts do not have to send golden penny money to the state for redistribution to poorer school districts (an important system known as recapture), overall system inequity will increase over time with the additional golden pennies.

School districts can raise an additional 11¢ from copper penny tax effort under current law. Copper pennies have a lower guaranteed yield than golden pennies and are subject to recapture.

HB 3 increases the copper penny guaranteed yield from $31.95 per copper penny to the amount produced by the basic allotment multiplied by 0.008. To prevent districts from raising new money due to this change, the state requires districts to reduce their copper penny tax rates to a level that produces the same revenue per student that was produced prior to the change in these formulae. Poorer school districts are more likely than wealthier districts to need to tax in the copper penny level. The HB 3 change means that poorer districts will be able to reduce their tax rates while still collecting the same funds they receive under the law before HB 3.

Property Tax Rate Reduction

Reducing property taxes was perhaps lawmakers’ prevailing focus of the 2019 Texas legislative session. In 2005, the legislature reduced school district property tax rates by one-third using a method referred to as “tax compression.” This statewide tax compression set the base tax rates for every school district at two-thirds of their base tax rate in 2005, when most districts taxed at or around $1.50 for every $100 of property value in the district. The 2005 law produced a compressed tax rate of $1.00 for most districts in the state.

The tax compression mandate left a $5 billion hole in state funding for schools. This eventually led to the devastating 2011 state cuts to school funding when state revenue increases failed to meet the unrealistic state revenue growth levels projected by the bill’s authors.

Now, HB 3 creates a new system of tax compression, combining statewide compression with district-by-district property tax compression. It also requires districts to reduce their property tax rates if the revenue they generate from those taxes will increase by more than 2.5% in any given year.

Allowing district-by-district compression will increase inequity in the school finance system. Wealthier school districts, with valuable property, can tax residents at lower rates, while poorer school districts will have to tax at higher rates to get the same funding. Without guarantees from the state to provide sufficient support to poorer school districts, HB 3’s compression approach violates one of the core principles of an equitable school finance system: similar tax effort should result in similar funding for schools.

Additionally, the focus on reducing property taxes leaves questions about future sources of funding for schools, as many wonder whether the state will be able to acquire new funding needed to cover increased school operating costs.

Despite the passage of HB 3, the state must make many more changes to ensure all students have access to excellent, equitable schools. IDRA will continue to push for research-based funding for special student populations, like English learners; equity studies that show the impact of changes to the school finance system; and democratic rulemaking that allows communities to understand and participate in policymaking that impacts their schools.

Resources

Commission on Public School Finance. (December 31, 2018). Funding for Impact: Equitable Funding for Students Who Need it the Most. Austin: Commission on Public School Finance.

IDRA. (2019). Most English Learners Would Be Excluded from the Proposed Dual Language Weight Policy brief. San Antonio: IDRA.

Morgan Craven, J.D., is the IDRA National Director of Policy. Comments and questions may be directed to her via email at morgan.craven@idra.org.

[©2019, IDRA. This article originally appeared in the June-July 2019 IDRA Newsletter by the Intercultural Development Research Association. Permission to reproduce this article is granted provided the article is reprinted in its entirety and proper credit is given to IDRA and the author.]