Tremendous differences existed in the amount of money available to educate children in public schools. Prior to 1995, some of the wealthiest school districts spent $10,000 for each of their students each year and had low school tax rates. Poorer school districts could only spend $3,000 a year for each student and had much higher school taxes. That was a difference of $7,000. That was the difference between a very basic education and a high quality education.

What did having less money and higher taxes in a school district mean for children? It meant that some children:

- learned in buildings that were unsafe

- had fewer learning opportunities

- tried to learn in overcrowded classrooms

- were taught by under-paid teachers

- were taught by poorly trained teachers

- were unprepared for college

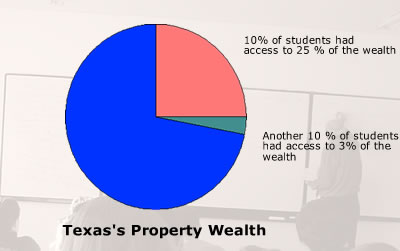

There was a 700 to 1 difference in the amount of property wealth per student in the 100 wealthiest school districts and 100 poorest school districts.

The 100 wealthiest school districts spent an average of $7,233 per student and had an average tax rate of 47¢. While the 100 poorest school districts spent an average of $2,978 per student and had an average tax rate of 74¢.

Source: Cárdenas, José A. 1985-96 State District Trial Court Records, Texas School Finance Reform: An IDRA Perspective (San Antonio, Texas: Intercultural Development Research Association, 1997).

Before Fair Funding

Fairer Funding for Education

Where We Are Now